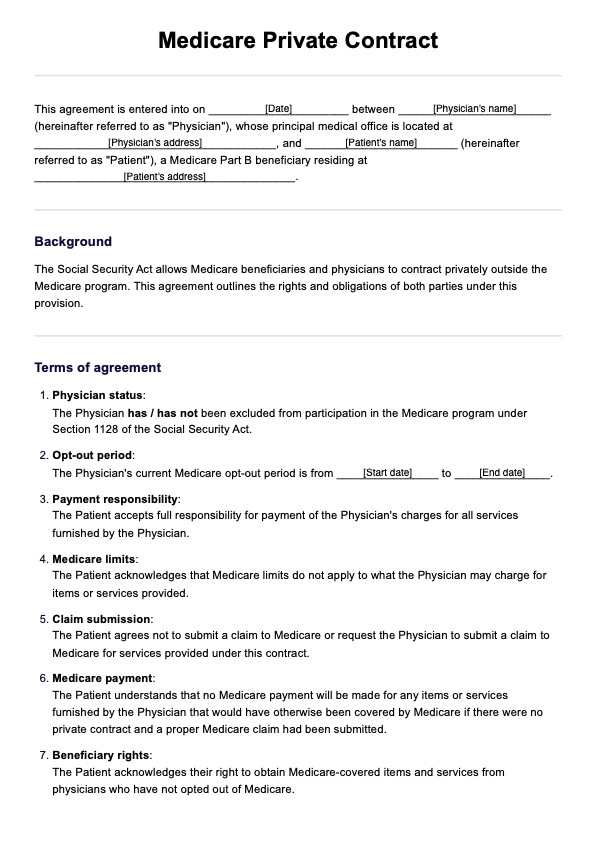

Yes, Medicare patients can choose to self-pay or privately contract by entering into private contracts with healthcare providers who have opted out of Medicare. In these cases, beneficiaries assume full responsibility for paying for services received directly from the provider.

Medicare Private Contract

Learn how a Medicare Private Contract works. Download a free blank PDF template to streamline your clinical documentation.

Medicare Private Contract Template

Commonly asked questions

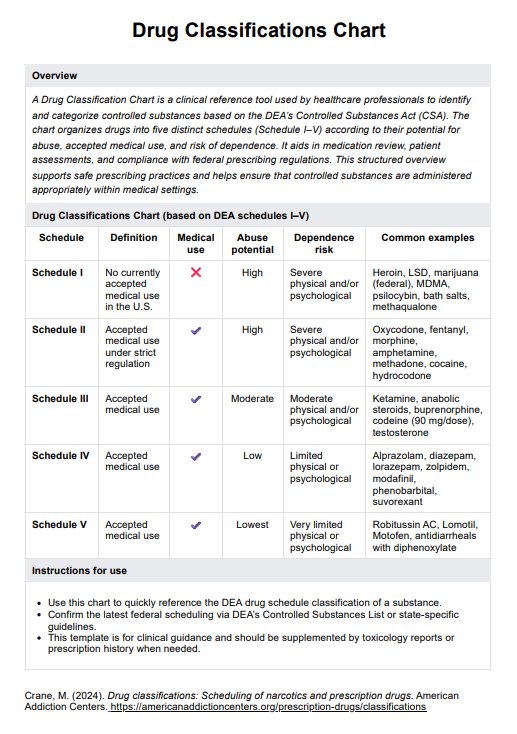

Medical billing contracts refer to agreements between healthcare providers, insurance companies, or government programs, such as Medicare or Medicaid. These contracts specify the terms, rates, and conditions under which the provider agrees to furnish services to covered individuals and be reimbursed by the payer.

Medicare beneficiaries can furnish emergency services through an opt-out provider, but they must understand that Medicare will not pay for these services unless the provider has not opted out.

EHR and practice management software

Get started for free

*No credit card required

Free

$0/usd

Unlimited clients

Telehealth

1GB of storage

Client portal text

Automated billing and online payments