Insurance Verification Form

Implement our insurance verification form template within your healthcare practice to elevate your processes. Intuitively designed, the form will save you time while improving data accuracy for reliable information input.

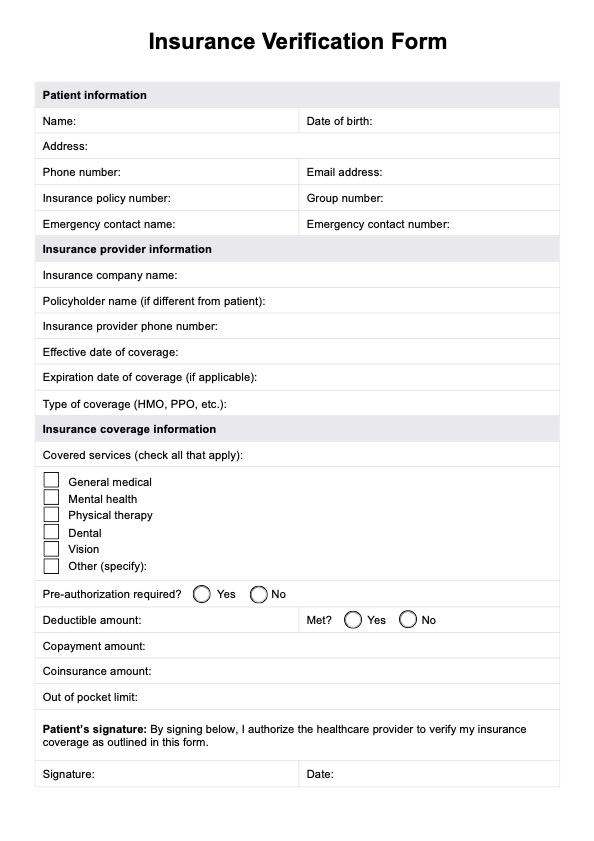

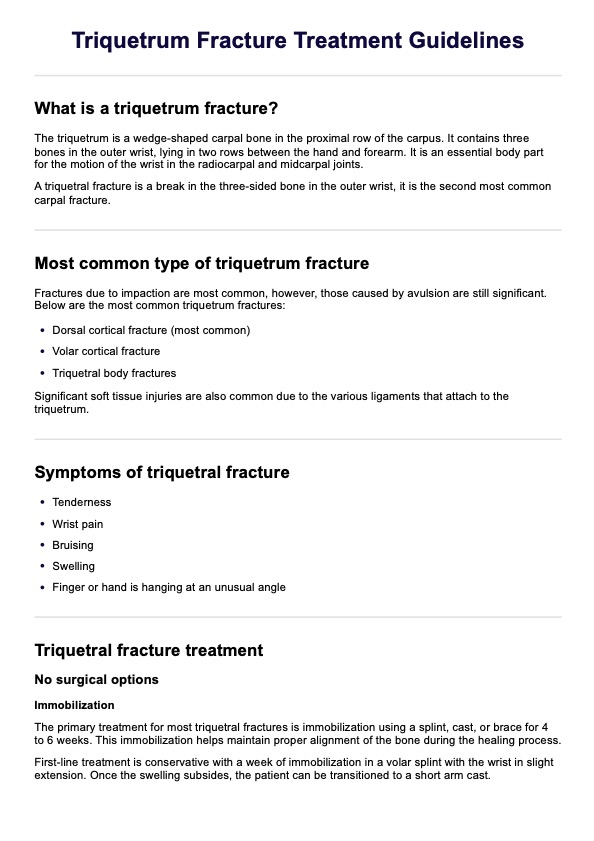

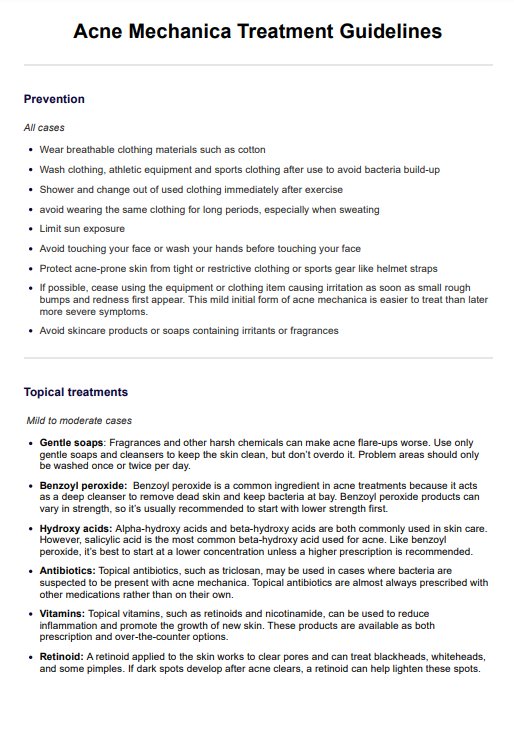

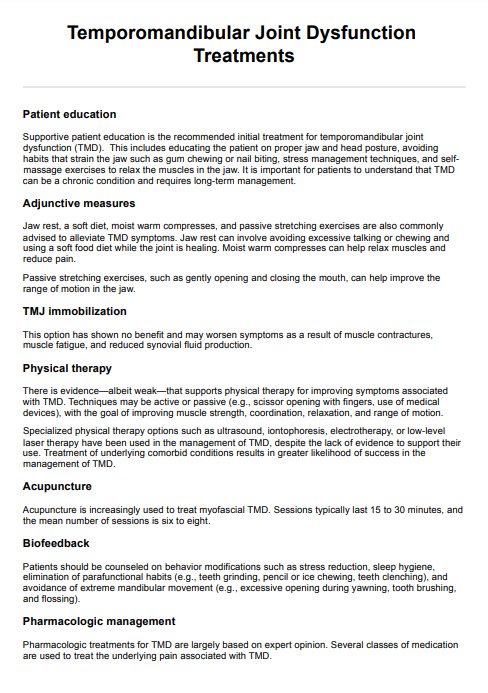

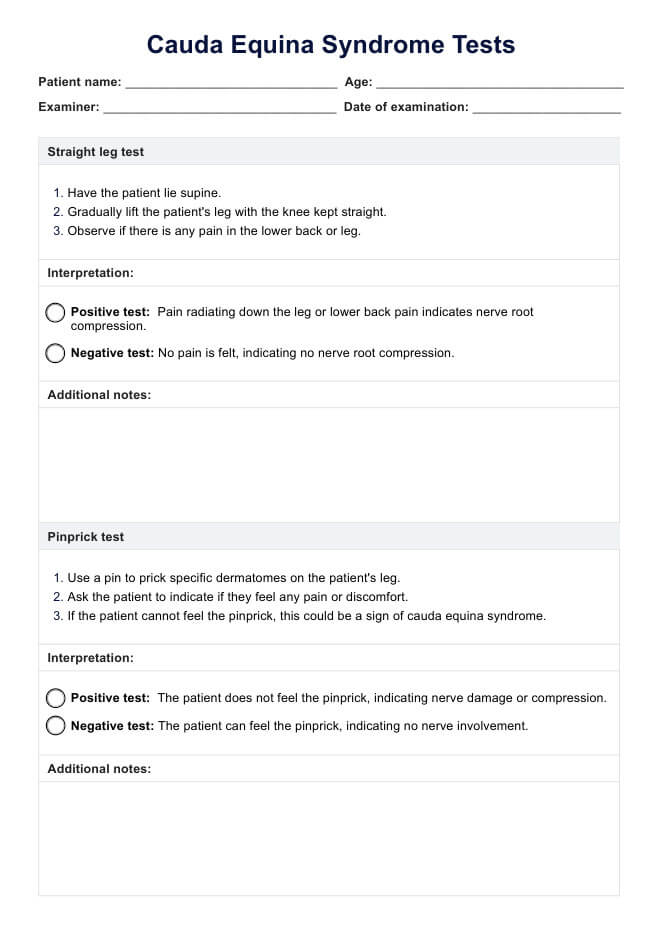

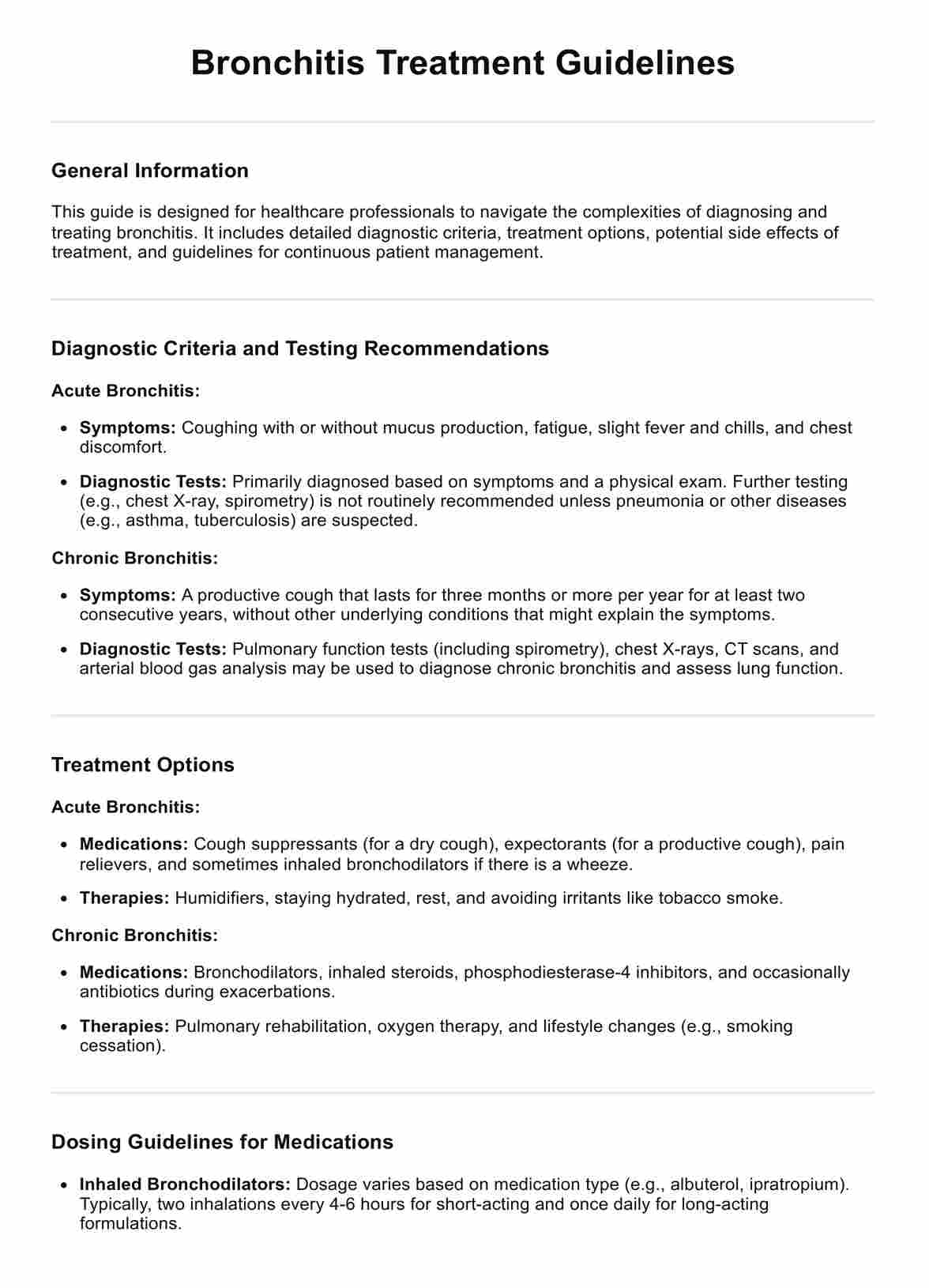

What is an Insurance Verification Form?

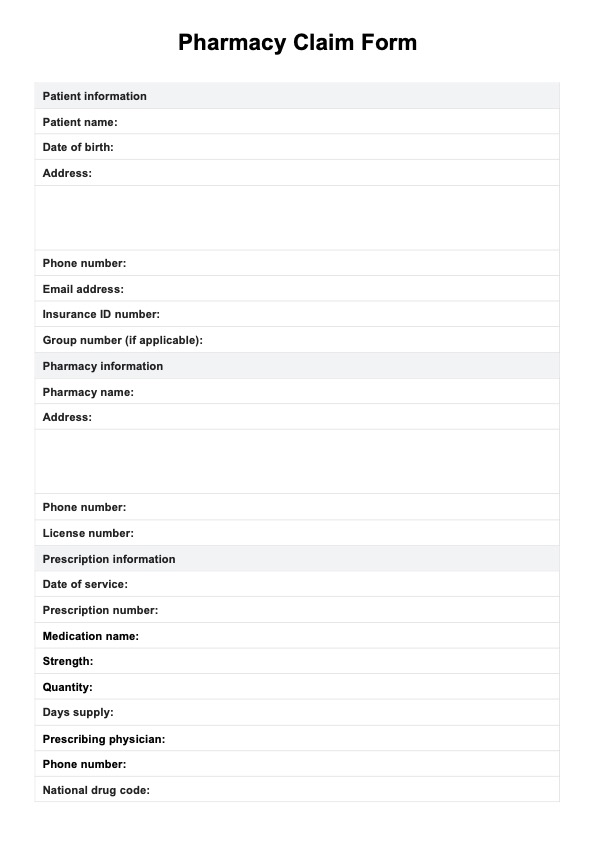

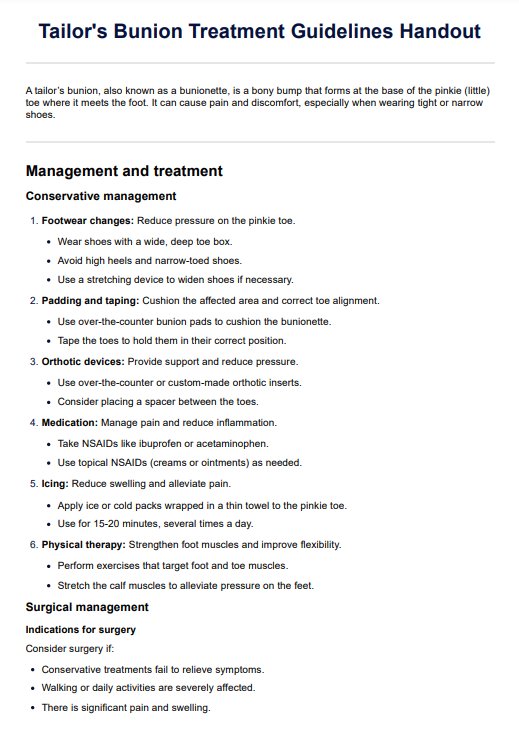

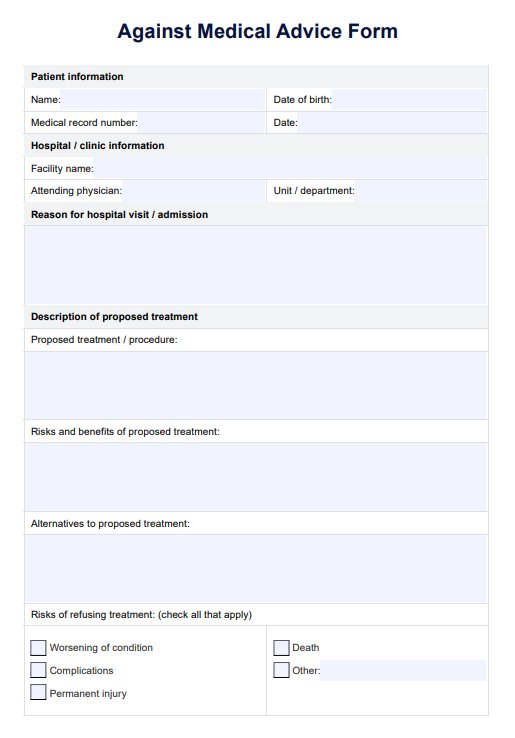

Managing insurance is crucial in healthcare. Verifying insurance coverage ensures faster reimbursement and reduces claim denials. Our downloadable medical insurance verification form allows healthcare providers to easily collect and confirm patient information, including personal and insurance details.

The form, which is simple and intuitive, helps confirm the validity of the patient's policy number and coverage before services are rendered. This process improves the medical office's efficiency, especially for new patients, and minimizes complications with insurance companies.

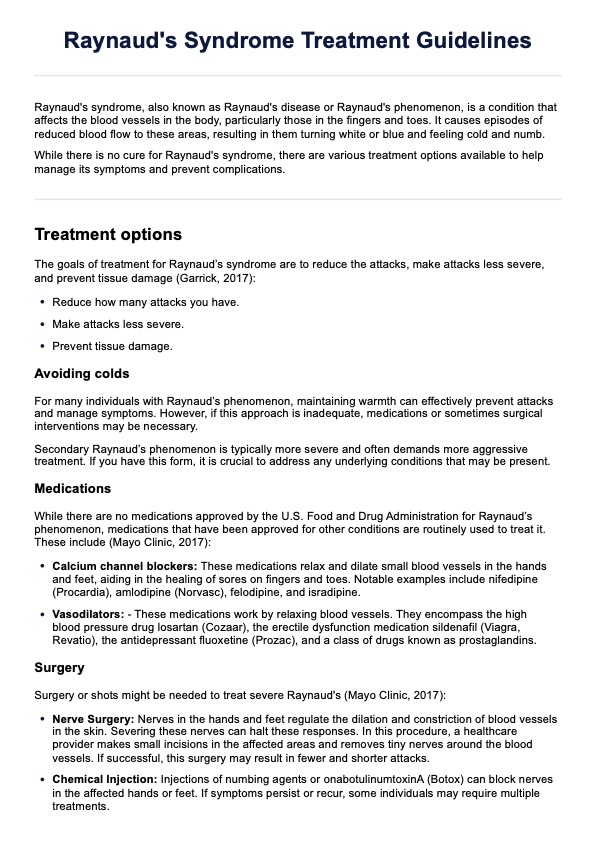

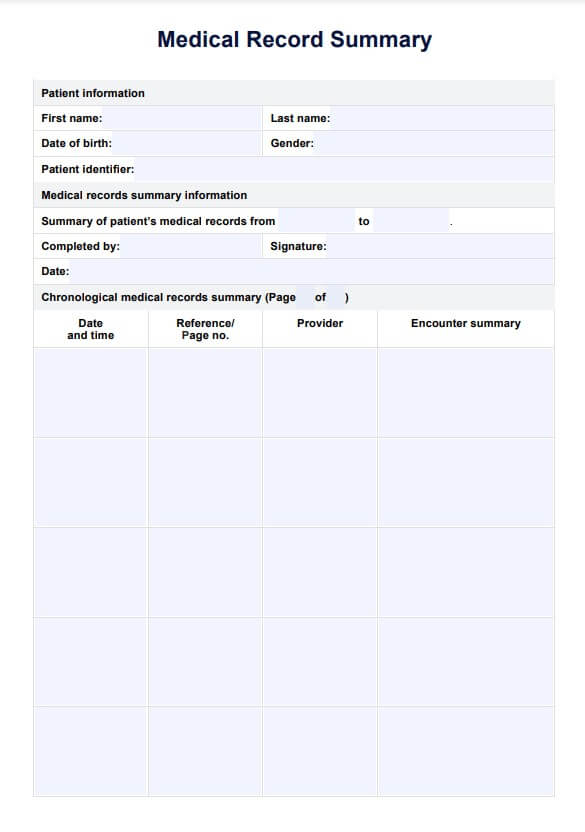

Insurance Verification Form Template

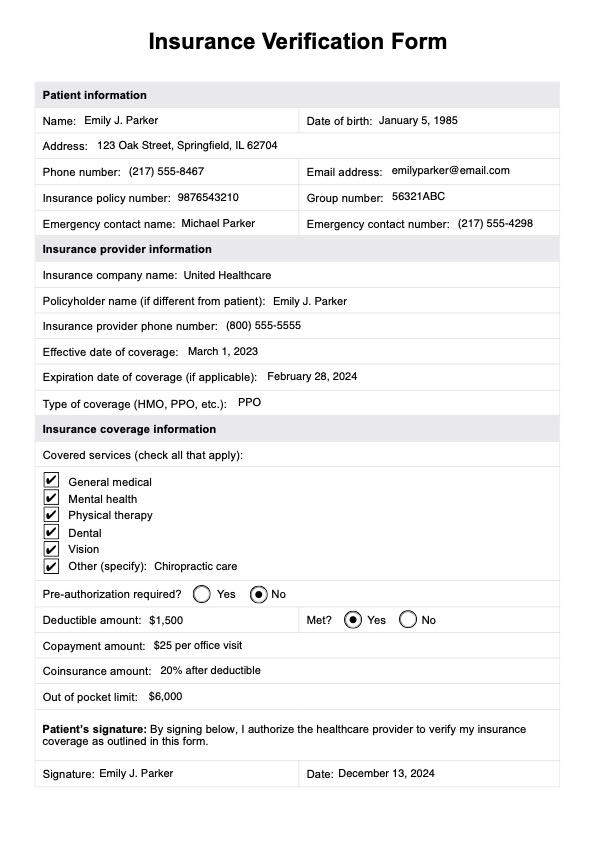

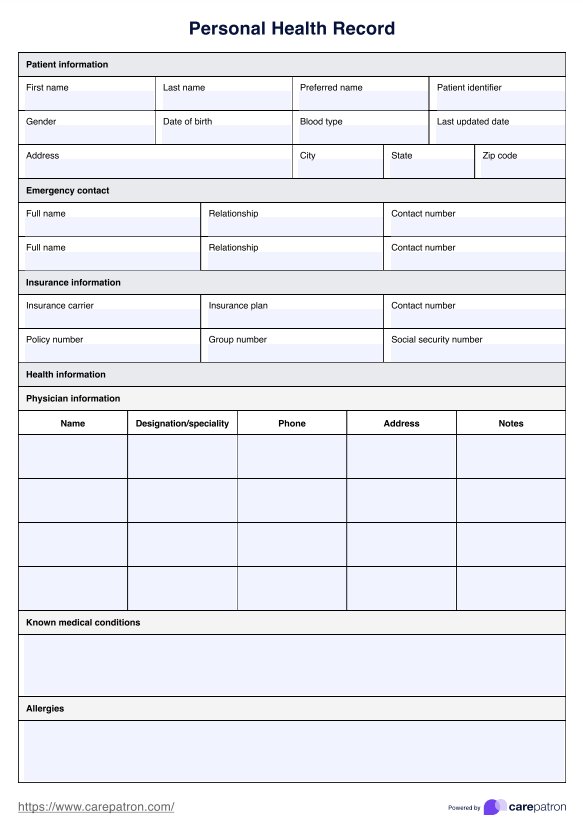

Insurance Verification Form Example

How to use this template for Insurance Verification Form

Although insurance is complicated, our insurance verification form template is not. In order to use it effectively within your practice, you simply have to follow this step-by-step guide:

Step 1: Access the verification form

To begin, download the PDF template. Click "Use Template" to access the free Insurance Verification Form through the Carepatron app, where you can customize it in minutes. To download a PDF version, click "Download."

Step 2: Distribute the form to patients

When new patients book their first appointment at your practice, you must give them a copy of the insurance verification form. Enabling patients to complete this part of the process reduces your workload while also allowing them to play a more involved role in their own care. You should encourage the patient to return the form to you in a timely manner so you can validate the insurance prior to their first appointment.

Step 3: Follow up with the information

After the patient returns the insurance verification form, it's time to begin the validation process. There are a couple of ways to do this. You can contact the insurance provider directly by phone, or if you'd prefer not to play phone tag, you can also check online websites and directories for provider information. Many healthcare businesses also have automated verification software, which is another efficient way of validating insurance.

Step 4: Input data to your system

The completed insurance verification forms will contain information that should be uploaded into the EHR system that your practice uses. As soon as the insurance company validates your patient's insurance plan, you should input this data into the client file so it can be accessed when submitting claims. Make sure you double (and even triple!) check that there aren't any mistakes, otherwise you can expect your claims to be consistently denied.

Step 5: Re-validate insurance

Although this step isn't exactly a requirement, we recommend rechecking and revalidating insurance plans around once every year. Patients are encouraged to inform their care providers if they make any changes to their insurance plan, but people are forgetful, and this is often overlooked.

Who can use this printable Insurance Verification Form?

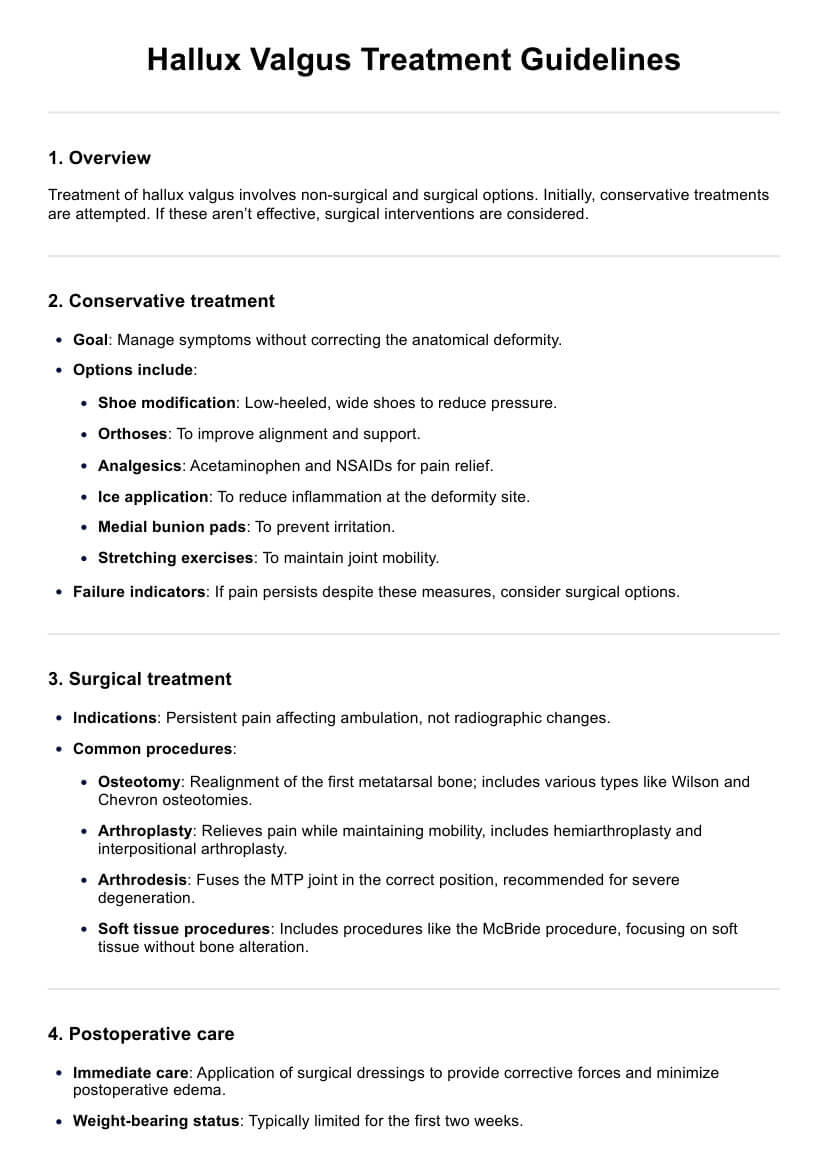

We understand the versatility of the healthcare industry, and our insurance verification form is designed to accommodate various needs. You may find that some sections of the form, such as those requesting specific personal and insurance information, may not apply to every patient. If this is the case, simply leave those sections blank. Here are some healthcare professionals who can benefit from using the form:

- General practitioners

- Nurses

- Counselors

- Psychologists

- Psychiatrists

- Physical therapists

- Mental health therapists

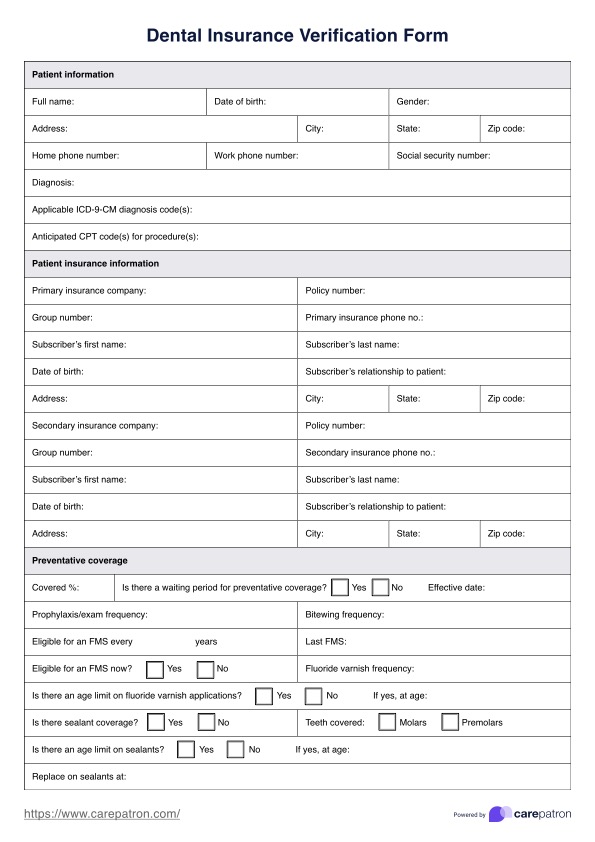

- Dental practitioners

- Occupational therapists

- Speech language therapists

- Chiropractors

The insurance verification process collects essential insurance information, such as personal details, contact details, and policy details, to efficiently verify insurance coverage and avoid issues with claims. Sections like the effective date and insurance provider may vary depending on the specific patient's insurance information, but the form helps streamline this process for medical staff.

Benefits of Insurance Verification Form PDF

Insurance verification forms additionally have a number of different benefits, for individual practitioners, the practice where they work, and the healthcare industry as a whole. These benefits include:

Reduce the number of claim denials

Denied claims are one of the most frustrating things that healthcare practices have to deal with. And if your practice is experiencing a high volume of these, then utilizing insurance forms may be the perfect solution. These documents gather accurate data and allow practices to easily prevalidate a patient's plan, ensuring that the claim contains only correct information.

Reduce administrative workload

Without an insurance verification form, the process of validating a patient's insurance is often left up to administrative staff. While this is occasionally fine, it can quickly become burdensome if you spend all your time chasing down patients for missing information. Distributing the verification form to patients will save a lot of time at your practice while having the additional bonus of getting patients more involved in their own care.

Improve transparency

Using the verification form will also help improve financial transparency. Receiving quality healthcare can be expensive and daunting for patients, and you must be honest and transparent with them about costs during the care delivery process. One of the best ways to do this is by prevalidating their insurance plan, so you can inform them of expected upfront fees early.

Optimize workflow

Optimized workflows are the key to running an efficient and productive business. Using resources like this insurance verification form will reduce patients' time in the waiting room as prevalidation will have already occurred. You'll be able to stick to your schedule and ensure patients have a seamless experience at your practice.

Focus on your patients

All of these benefits allow you to spend more time and effort focusing on your patients' needs. By getting the insurance validation out of the way before you initially see your patient, you can spend more time developing an effective and responsive treatment plan.

Commonly asked questions

The form asks for essential personal and insurance information, including the patient's policy number, group number, and contact details. This helps to validate coverage and streamline the insurance verification process.

Once the form is filled out and returned, you can access the patient's insurance information and contact the provider to determine if their services are covered under their plan.

Yes, you can fill out the insurance verification form electronically or print it to complete manually. Either method allows for easy submission and quick validation of the patient's policy information.