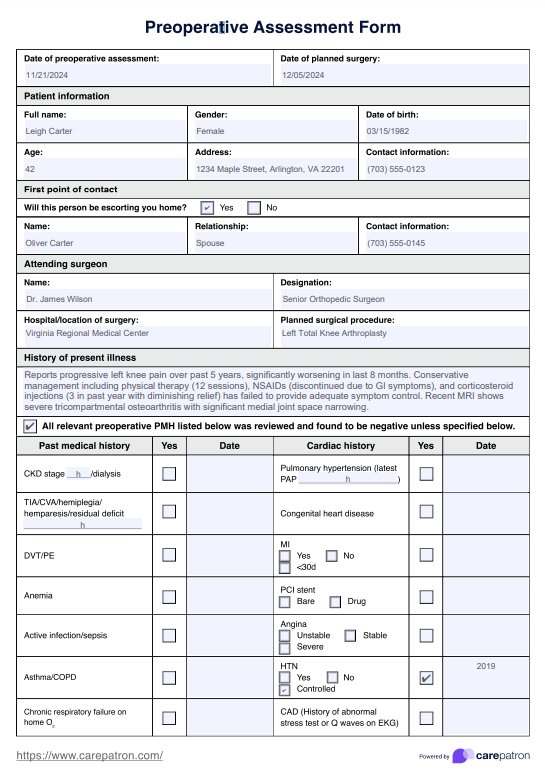

Medicare Fact Sheet

Download a free Medicare Fact Sheet for your patients. Learn how Medicare works with our free template.

What is Medicare?

Medicare is a federal health insurance program primarily for individuals who are 65 years or older, as well as for some younger individuals with disabilities and people with end-stage renal disease. It is divided into parts, each covering different healthcare needs.

Medicare offers different parts: Part A, Part B, Part C (also known as Medicare Advantage), and Part D. These cover different healthcare needs like hospital insurance, medical insurance, prescription drug coverage, and more.

Medicare spending is funded through various sources, including general federal revenues, payroll taxes from employees and employers, premiums paid by Medicare beneficiaries, taxes on Social Security benefits, interest earned on trust fund investments, funds authorized by Congress, and payments from states.

These funds are allocated to different parts of Medicare, such as Part A, Part B, and Part D, each with its specific financing structure. The Centers for Medicare and Medicaid Services (CMS) administers the program, while the Social Security Administration handles enrollment.

Medicare Fact Sheet Template

Medicare Fact Sheet Example

Medicare parts

As mentioned, Medicare is divided into different parts, each with its own coverage set. Here are the main parts of Medicare and what they cover:

Part A

Also known as hospital insurance, it provides coverage for key healthcare services, including inpatient hospital care, care in skilled nursing facilities, hospice care, and home health care.

Part B

Part B, or medical insurance, covers services from doctors and other healthcare providers, outpatient care, home health care, and durable medical equipment. Additionally, it offers coverage for preventive measures, including select vaccines and cancer screenings.

Part C

Also called Medical Advantage, Part C combines Parts A and B coverage and may include additional benefits like dental, vision, and hearing care. These plans are provided by private insurance companies approved by Medicare.

Part D

This is Medicare drug coverage, which can be added to Original Medicare (Parts A and B), some Medicare Cost Plans, some Private Fee-for-Service plans, and Medical Savings Account.

Medicare benefits

Medicare offers a wide range of benefits to help cover healthcare expenses. These include:

- Inpatient hospital stays: Medicare Part A covers medically necessary inpatient care in hospitals, including semi-private rooms, meals, and supplies.

- Outpatient services: Medicare Part B covers medically necessary outpatient care, such as doctor visits, lab tests, and preventive services.

- Prescription drugs costs: Medicare Part D covers prescription drugs through plans offered by private insurance companies approved by Medicare.

- Home health care: Both Part A and B cover medically necessary home health care services, including skilled nursing care, physical therapy, and occupational therapy.

- Preventive services: As mentioned earlier, Medicare covers a range of preventive services to keep beneficiaries healthy and detect any potential health issues early on.

- Additional benefits: Medicare Advantage (Part C) may offer additional benefits like dental, vision, and hearing care that are not covered by Original Medicare.

It's important to note that the specific coverage and costs of these benefits may vary depending on the type of Medicare plan the patients have. For example, Original Medicare does not typically cover prescription drugs, but they can be added through a separate Part D plan.

Medicare coverage gaps

While Medicare offers comprehensive coverage for many healthcare expenses, there are some gaps that beneficiaries should be aware of:

- Deductibles and coinsurance: Like most insurance plans, Medicare has deductibles and coinsurance that beneficiaries are responsible for paying. These amounts can vary depending on the type of Medicare plan and the services received.

- Limited coverage for long-term care: Original Medicare does not typically cover long-term care in a nursing home or assisted living facility. This type of care is only covered under certain circumstances, such as for short-term rehabilitation or skilled nursing care.

- Limited coverage for dental, vision, and hearing: Original Medicare does not cover routine dental, vision, or hearing services. However, some Medicare Advantage plans may offer these benefits as an added feature.

Commonly asked questions

Monthly premiums for Medicare Advantage plans can vary widely based on the provider, coverage options, and region. Unlike Original Medicare, which has standardized Part B premiums for all beneficiaries, Medicare Advantage plans may offer lower or sometimes $0 premium options, but this can depend on the specific benefits covered, such as prescription drug costs.

Yes, Medicare Part D covers prescription drug costs for beneficiaries. Private insurance companies approved by Medicare offers these plans and include a variety of medications at different cost levels.

Medicare taxes are federal payroll taxes collected from employees, employers, and the self-employed. These taxes contribute to funding Medicare Part A (Hospital Insurance). Employees and employers each pay a Medicare tax rate of 1.45% on wages, with self-employed individuals paying the full 2.9% since they cover both the employee and employer portions.