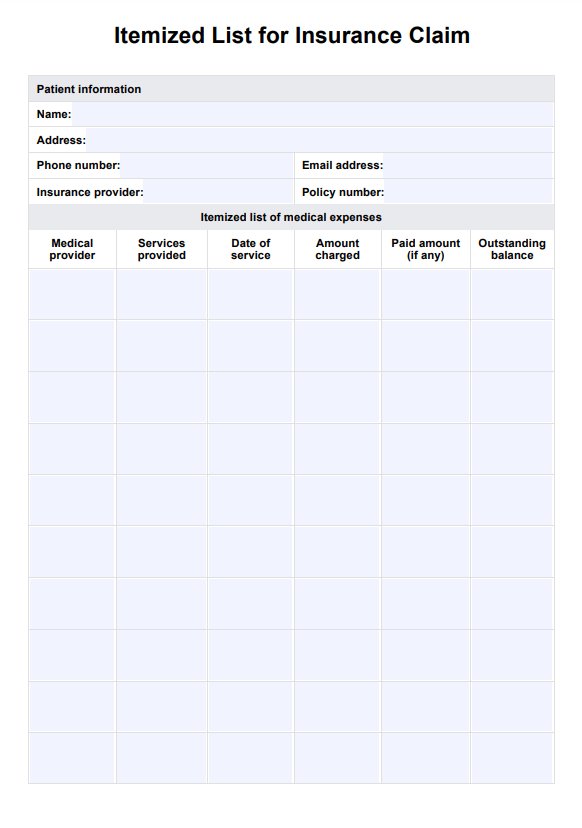

Itemized List for Insurance Claim templates are used when filing medical insurance claims to document expenses for treatments, equipment, or services. They help ensure that the insurance company processes all charges transparently and accurately.

Itemized List For Insurance Claim

Get a free Itemized List For Insurance Claim template to help patients with insurance claims. Access the PDF and example in this guide.

Use Template

Itemized List For Insurance Claim Template

Commonly asked questions

Yes, the itemized list can be customized to fit your specific insurance claims, allowing you to create and adjust it based on your needs and the requirements of your insurance policy.

Yes, Carepatron’s Itemized List for Insurance Claim is free for healthcare professionals to streamline insurance claim submissions.

EHR and practice management software

Get started for free

*No credit card required

Free

$0/usd

Unlimited clients

Telehealth

1GB of storage

Client portal text

Automated billing and online payments