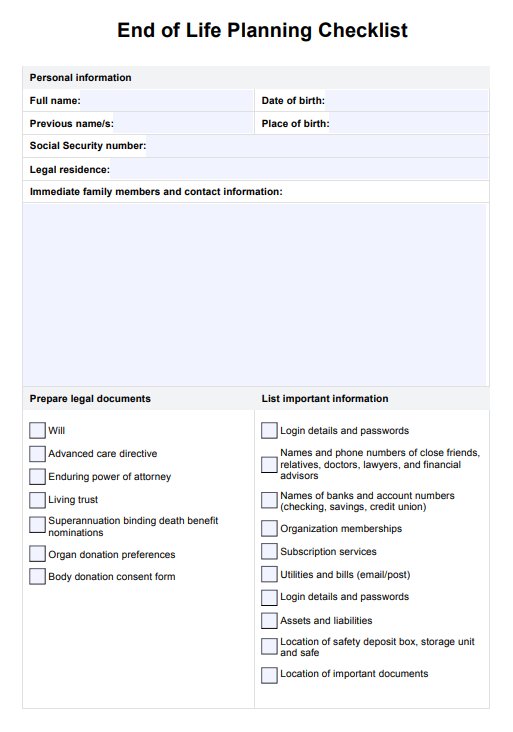

End Of Life Planning Checklist

Help patients facilitate end of life decisions with our End of Life Planning Checklist. Download a PDF copy here.

What is an End of Life Planning Checklist?

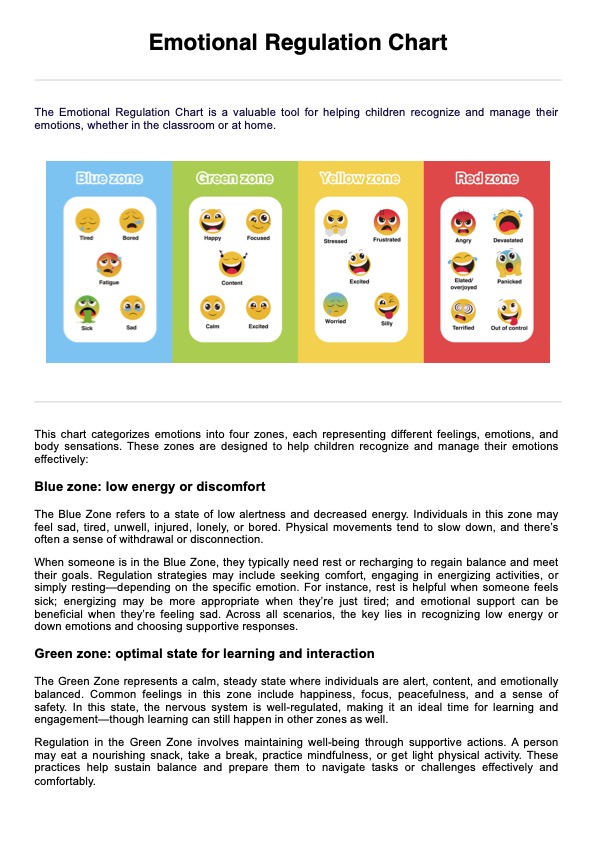

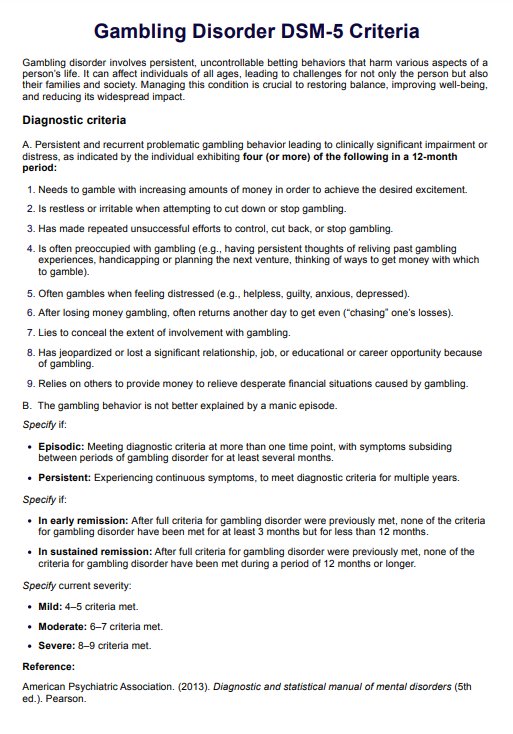

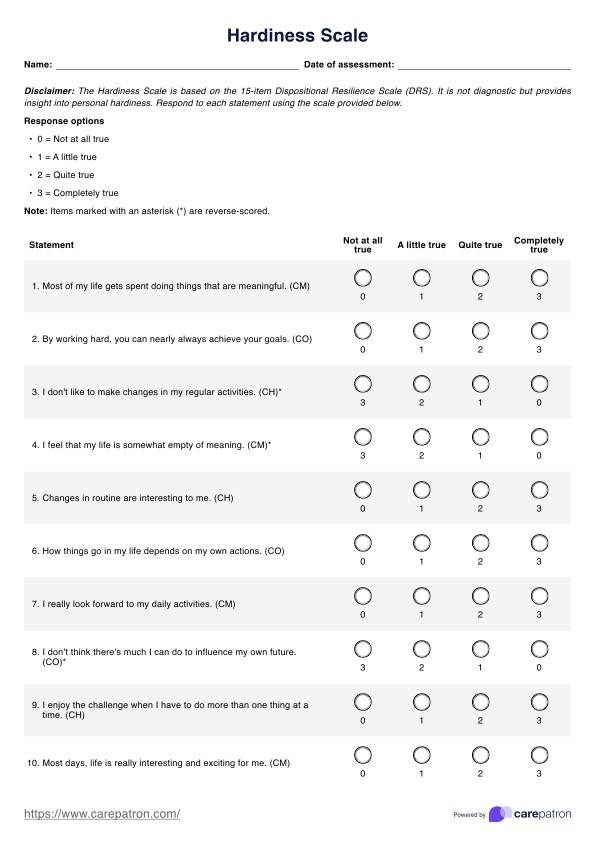

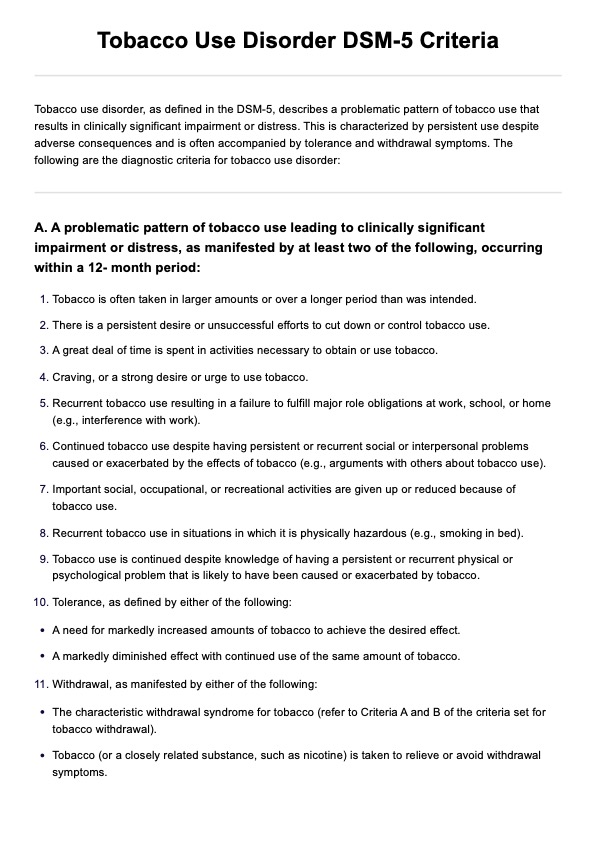

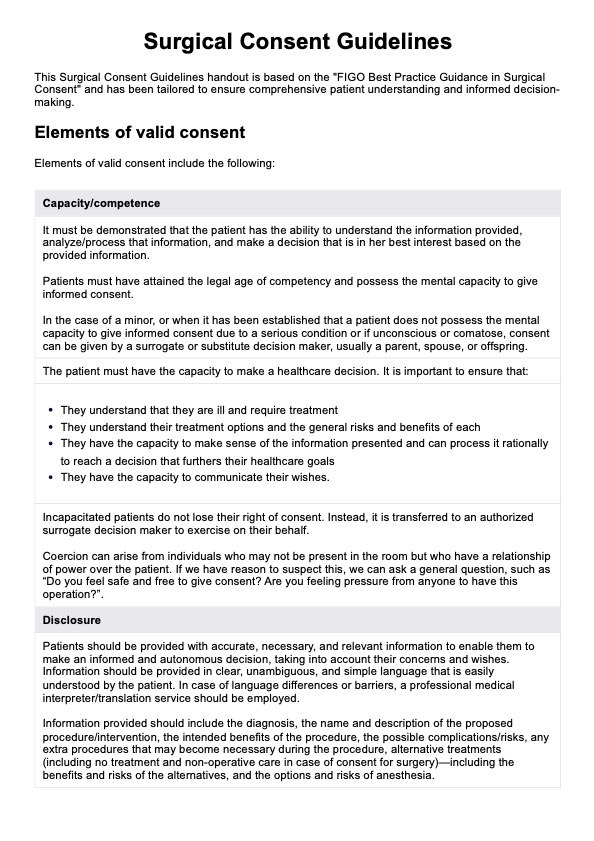

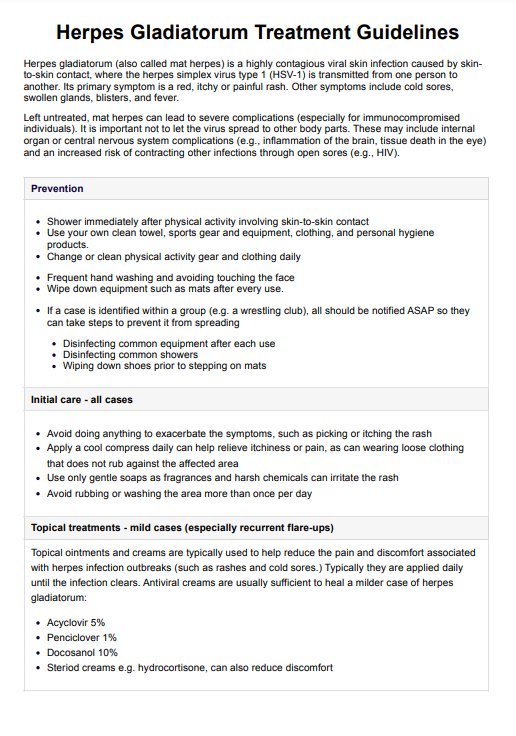

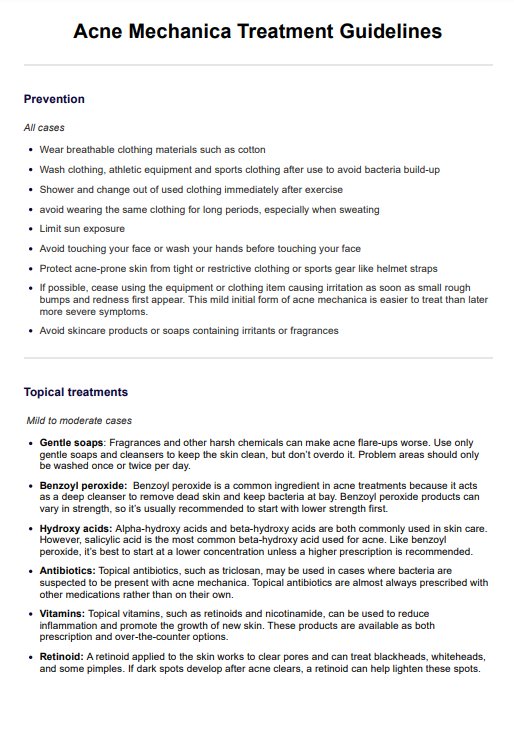

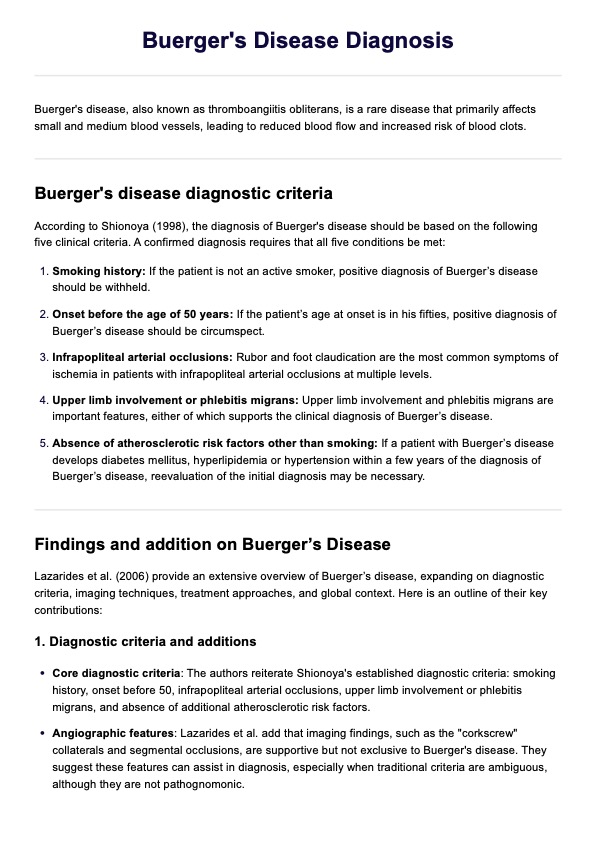

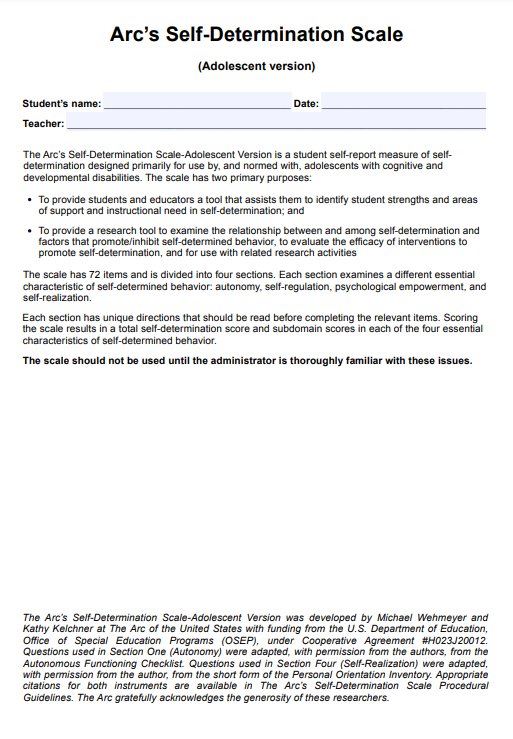

An End of Life Planning Checklist is a comprehensive resource for organizing and documenting crucial decisions about an individual's end of life plan. This includes information about medical care, legal matters, and funeral arrangements before they become immediately necessary. This structured approach helps ensure that all important aspects of end of life care are addressed thoughtfully and thoroughly.

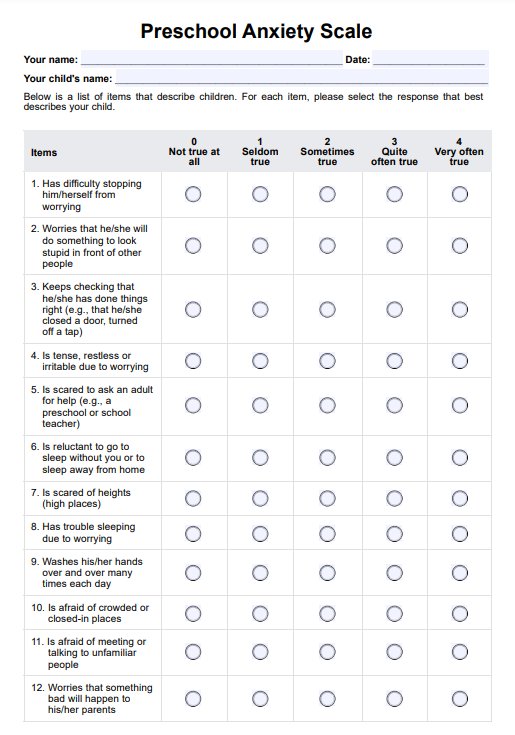

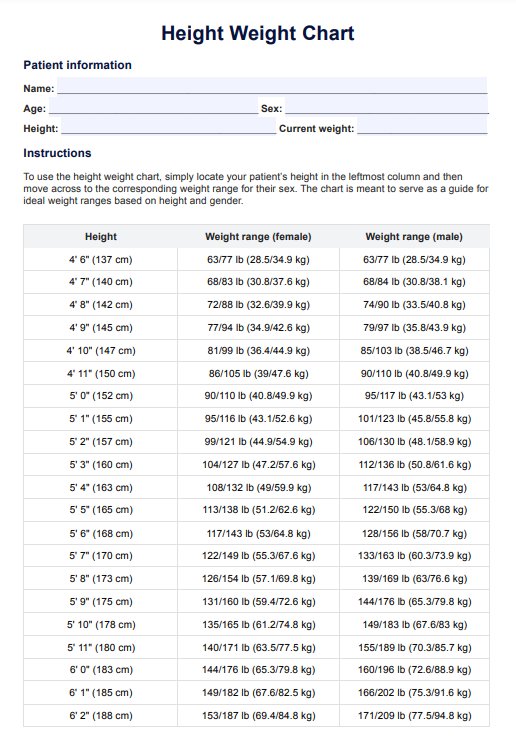

The checklist can cover several essential areas of planning. In terms of healthcare preferences, it covers documentation of preferred medical treatments, choices about life-sustaining treatment, pain management preferences, selection of healthcare providers and facilities, creation of advance directives, and organ donation decisions.

Legal preparations are also crucial, including establishing a living will, designating a durable power of attorney, appointing a health care proxy, considering a revocable living trust, and preparing a last will and testament.

Financial organization is equally important. This includes reviews with the life insurance provider, bank account documentation, evaluating financial assets, and debt management planning. Financial clarity helps prevent confusion and ensures proper asset and obligation management.

Finally, it is also important to address funeral and burial arrangements, funeral or memorial service wishes, religious or cultural considerations, an obituary and death notice, and messages for family members. These elements help ensure that final wishes are honored and that loved ones have clear guidance about personal preferences.

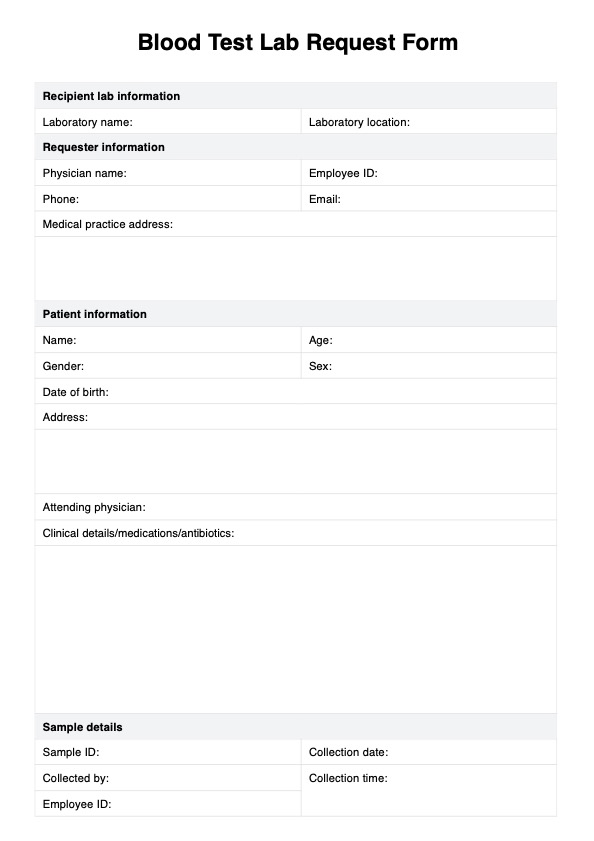

End Of Life Planning Checklist Template

End Of Life Planning Checklist Example

How does our End of Life Planning Checklist work?

The End of Life Planning Checklist is a systematic tool designed to guide practitioners and patients through the comprehensive planning process. The following are steps on how to make the most out of this resource:

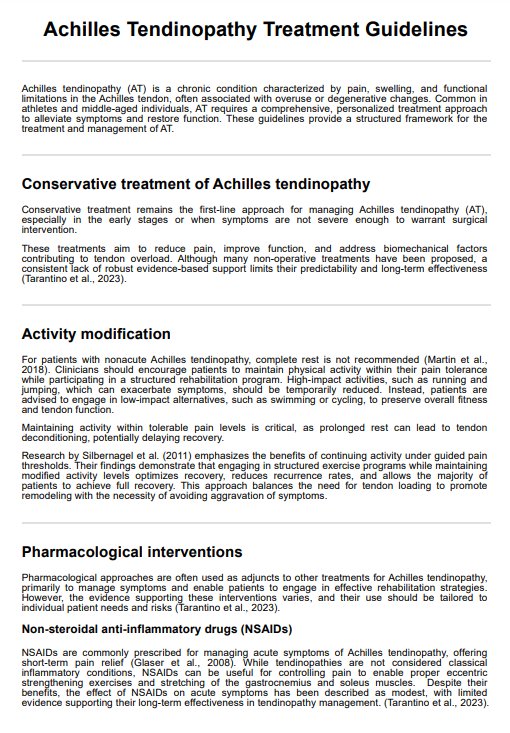

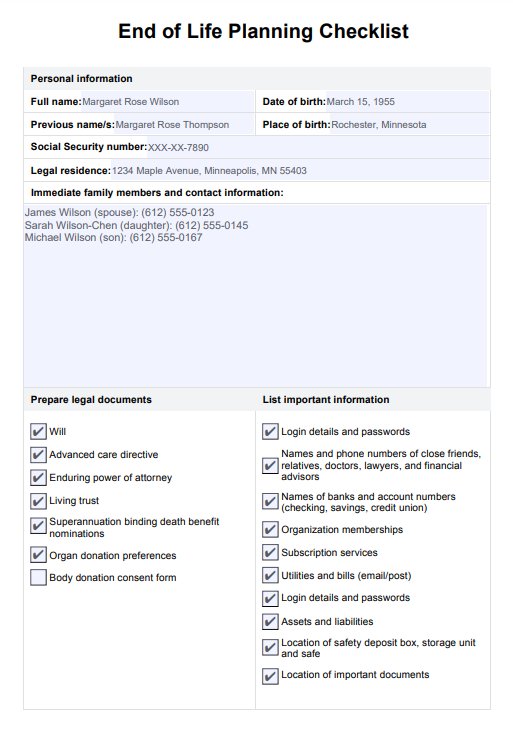

Step 1: Gathering essential personal information

Begin by documenting fundamental personal details, including full legal name, date and place of birth, social security number, and current legal residence. This step also involves creating a comprehensive contact list of immediate family members and important connections. This ensures all subsequent planning and documentation can be properly attributed and connected to the individual's identity and support network.

Step 2: Legal and financial documentation

Focus on assembling and completing crucial legal documents such as the will, advanced health care directive, enduring power of attorney, and living trust. This step includes gathering existing financial documentation like superannuation statements, their life insurance policy, bank statements, and asset records.

Step 3: End of life preferences

Document specific preferences regarding end of life care, including the desired location of care, who should be present, and notification preferences.

Step 4: Funeral planning and personal arrangements

Address funeral and memorial preferences, including choices about burial or cremation, service details, and final resting place preferences. This step also covers end of life arrangements such as care instructions for children and pets, distribution of personal items, and any messages or legacies to be shared with loved ones.

When would you use this checklist?

The End of Life Planning Checklist is helpful during various life stages and transitions. Its use extends beyond terminal illness, proving valuable in multiple scenarios where comprehensive planning benefits individuals and their family members.

During major life transitions

The checklist becomes particularly relevant during significant life changes, such as a client moving into an assisted living facility or nursing home. These transitions often require reviewing and updating important legal documents and establishing new healthcare arrangements. It's also an appropriate time to review life insurance policies and establish or update a durable financial power of attorney to ensure proper management of bank accounts and other assets.

When making healthcare arrangements

The checklist also helps when establishing long-term healthcare plans or making decisions about medical treatment. This includes situations where individuals must designate health care power arrangements or update their durable medical power of attorney. These decisions often coincide with changes in health status or when establishing relationships with new healthcare providers.

During financial and legal planning sessions

Financial planning sessions are ideal for utilizing this checklist, particularly when discussing estate planning or the probate process. While the checklist is not a legal document, it aids in reviewing or establishing a domestic partnership agreement, updating beneficiary designations, or reorganizing assets.

Before major medical procedures

During scheduled medical procedures or receiving new diagnoses, the checklist helps document all necessary medical decisions for the patient. This proactive approach ensures that preferences and arrangements remain current and aligned with changing circumstances.

Benefits of using a checklist for end of life planning

A structured checklist approach to end of life planning offers numerous advantages for healthcare providers and individuals navigating this process. This includes the following:

Enhanced comprehensiveness and accuracy

Using a checklist ensures that no critical aspects of end of life planning are overlooked. This approach helps capture essential details across medical, legal, and personal domains. The structured format prompts consideration of items that might otherwise be forgotten, such as digital asset management or specific religious preferences for care.

Improved communication and clarity

A checklist format facilitates communication between healthcare providers, patients, and family members. It creates a common framework for discussing sensitive topics and ensures all parties understand and acknowledge the documented preferences.

Efficient documentation and updates

The checklist format efficiently tracks completed items and identifies areas requiring attention. It simplifies the process of regular reviews and updates, ensuring that preferences and arrangements remain current as circumstances change. This systematic organization also makes it easier for healthcare providers to quickly locate and reference critical information when needed, particularly during emergencies.

Reduced emotional burden

The checklist approach helps reduce the emotional overwhelm often associated with these discussions by breaking down the complex end of life planning process into manageable steps. It also helps healthcare providers maintain professional boundaries while ensuring comprehensive care planning.

Commonly asked questions

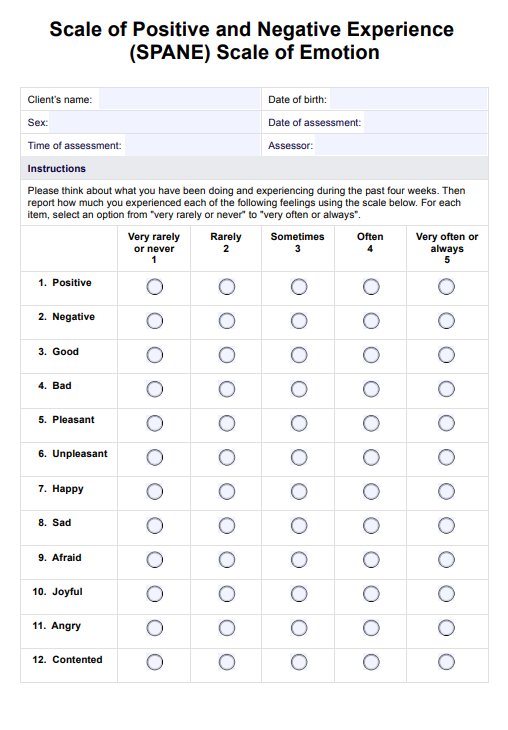

Essential paperwork for end of life planning includes a will, which outlines the distribution of assets and appoints guardians for dependents; advance directives or living wills, detailing medical care preferences if one cannot communicate; and powers of attorney, which designate individuals to make financial or healthcare decisions on the patient's behalf.

Strategies for preparing for end of life include discussing one's wishes with family and healthcare providers, organizing important documents like insurance policies and bank details, and considering pre-planned funeral arrangements to ease the burden on loved ones.

An effective end of life care plan should encompass a living will specifying medical treatment preferences, a durable power of attorney for healthcare decisions, a last will and testament for asset distribution, and instructions for funeral arrangements, ensuring that both healthcare wishes and personal desires are respected.

-template.jpg)